Money Transfers: Understanding the Differences Between Bank Transfers, EFT, SWIFT, and Instant Payment Systems

Domestic and international money transfers have grown in importance as trade and daily living require more money to be moved from one location to another. This is due to technical improvements and the expansion of international trade. The plethora of methods and institutions available for both domestic and international transfers can make the simple act of transferring money seem complicated. This article explores the fundamental processes of money transfers, detailing their limits, fees, and time constraints.

Let's start with some terms you should know when sending or receiving money domestically or internationally:

IBAN (International Bank Account Number)A unique account number created for every account used in domestic and international money transfers.

Account NumberThe unique identifier of an e-wallet or bank account given to each customer.

SWIFT CodeA unique identification code banks use for processing international money transfers, standing for Society for Worldwide Interbank Financial Telecommunication.

Internal TransferThe process of transferring funds between accounts owned by the same person, usually within the same bank.

E-WalletAn online tool for managing financial transactions electronically and making digital payments, offering security measures to protect users' payment information.

EFT (Electronic Funds Transfer)Refers to inter-bank electronic money transfers facilitating fund transfers between different banks or accounts within the same bank.

Bank TransferAn electronic transfer of money between different accounts within the same bank.

Instant Payment SystemA system enabling instant money transfers, not limited to banking hours, available 24/7 within certain limits.

Bank Transfer: How Does It Work?

A bank transfer is sending money from one account to another within the same bank domestically. This can be done through bank branches, ATMs, or digital channels. The fee for a bank transfer varies by bank; some may charge based on the amount transferred, while others may not. Due to its intra-bank nature, bank transfers are generally faster and cost less than other methods. Key terms associated with money transfers include:

Electronic Funds Transfer (EFT)

Unlike bank transfers, EFT allows for transferring funds from one bank account to another across different banks. This facilitates inter-bank fund transfers, with the transfer time-varying due to inter-bank traffic and technical details. In some countries, EFT transactions are confined to banking hours, and the sender bears the fee.

Instant Payment System

An instant payment system differs from bank transfers and EFT by providing a bank-independent platform for quick transfers. For instance, in some countries, instant payment systems allow for real-time transactions beyond banking hours, with limits set by central banking authorities. Fees for using this system may vary by bank.

SWIFT: The Global Standard for International Transfers

SWIFT stands for Society for Worldwide Interbank Financial Telecommunication, facilitating electronic fund transfers worldwide. Established in 1973 and headquartered in Brussels, Belgium, SWIFT includes over 11,000 financial institutions and banks globally. It's used for commercial payments in foreign currencies and international money transfers, with each bank having a unique SWIFT code to simplify transfers. Transactions typically occur through bank branches, internet banking, or mobile apps.

SWIFT Transactions: Duration and Fees

International transfers via SWIFT can take a few hours to several days, depending on specific conditions and the banks involved. The fees vary based on the bank's policies and the amount transferred. SWIFT does not set transaction limits; these are determined by the bank or financial institution's policies, the customer's account type, and other factors.

Choosing the Best Money Transfer Method

The best, fastest, or cheapest method varies by individual needs and circumstances. Considerations should include:The locations of the sender and recipient.The amount to be transferred.The urgency of the transaction.Security concerns.Especially for international transfers, selecting a secure and reputable financial institution or service provider is crucial.

Safety and Security in Money Transfers

The safety of your funds and personal information is paramount during a money transfer. Reputable services use advanced encryption and security protocols to protect transactions. However, users should also take precautions, such as verifying the recipient's details, using secure internet connections, and avoiding sharing sensitive information over unsecured channels. Awareness of common scams and choosing reputable transfer services can significantly reduce the risk of fraud.

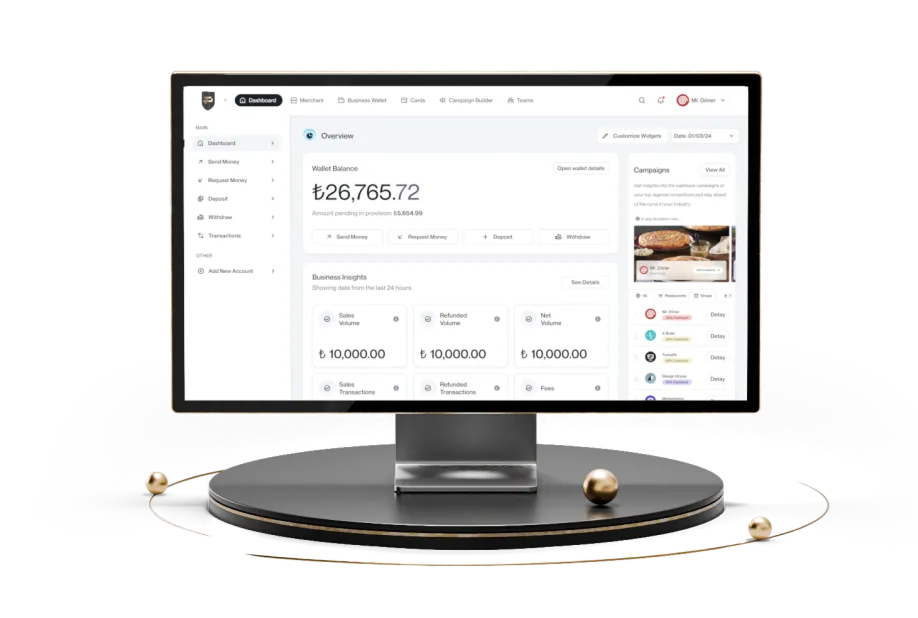

Enjoy 24/7 Free Money Transfers with Papel

With Papel, enjoy the convenience of sending money for free 24/7. Discover a new financial experience free from transaction fees, slow transfers, and complicated processes.