How to Transfer Money Using an IBAN Number?

Going beyond local account numbers, the IBAN enables standardized international transactions, allowing users to send money domestically and abroad in just a few steps. So, what is an IBAN, how is it used, and what should you be aware of when transferring money? In this article, we walk you through everything you need to know about transferring money via IBAN, including mobile banking, digital wallets, and critical security steps.

What is an IBAN?

The IBAN (International Bank Account Number) is an internationally standardized format for bank accounts that includes local account details. In Turkey, an IBAN begins with the two-letter country code (TR), followed by a two-digit check number, a five-digit bank code, a one-digit national check digit, and a sixteen-digit account number, totaling 26 characters. This structure standardizes all account information into one format, providing speed and security in both domestic and international transactions. While IBAN lengths may vary by country, they can be up to 34 characters in length.

Difference between IBAN and account number

Account numbers are used only for local transactions. In contrast, IBANs include the country code, check digits, bank or branch code, and account number, making them suitable for both domestic and international use. While account numbers are more prone to user errors, the check digits in an IBAN help detect mistakes before transactions are processed. Additionally, sending international transfers using an account number usually requires extra information, whereas an IBAN is sufficient for both domestic and international transfers. In short, an account number is a local identifier. In contrast, an IBAN includes additional international details, such as the country code and check digits, making it a more comprehensive account number format.

Methods for sending money using an IBAN

There are several easy methods for transferring money using an IBAN. The most commonly used ones are:

Transfer via mobile banking

Using the bank’s mobile app, you can easily transfer money via IBAN through the “Money Transfers” or “FAST/EFT” menu. After entering the recipient’s IBAN and full name and setting the transfer amount, FAST transactions can be completed within seconds, even outside business hours or on official holidays. Alternatively, EFT transactions are processed on the next business day.

Transfer via internet banking.

By logging into your bank’s internet branch, you can transfer money via IBAN through the “Money Transfers” or “Transfer to Another Account/EFT” menu. The recipient’s IBAN and full name must be entered accurately. Some banks may also require the bank name and branch information. While FAST transfers can be made at any time, they may incur extra fees. Therefore, EFT transactions conducted during weekday working hours may be preferable in some cases.

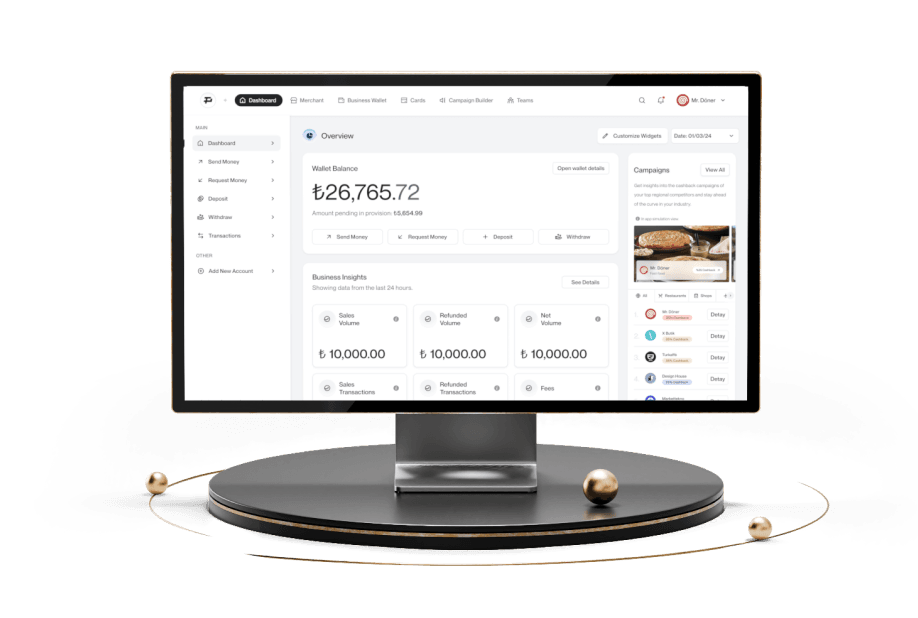

Transfer via Papel

With the Papel digital wallet, you can easily transfer money to an IBAN or another Papel wallet. Thanks to the in-chat transfer feature, you can send money to your friends directly through messages without needing to enter an IBAN. With Papel, you can transfer money 24/7 with no extra fees. International transfers are also available with fixed costs of just $1 or €1.

Essential considerations when sending money via IBAN

When making an IBAN transfer, it’s necessary to pay attention to the following key points:

Entering the IBAN correctly and completely

You must enter the IBAN wholly and accurately. Using the copy-paste method is recommended. Avoid adding unnecessary spaces or characters. Incorrect digits may cause funds to be transferred to the wrong account or result in transaction failure.

Verifying recipient information

Ensure that the recipient’s full name, bank name, and branch code (if required) are correct. This reduces the risk of transferring funds to the wrong account and increases transaction security.

Filling in the reference field

Do not leave the description field blank. Notes like “Rent May 2025” or “Invoice No: 1234” help the recipient identify the transaction and can serve as evidence in case of future disputes. Leaving this field blank may cause legal complications in some instances.

Fees and exchange rate differences for international transfers

When sending money abroad, be sure to check the fees and exchange rate margins applied by banks or digital services. These charges can affect the final amount the recipient receives. With Papel, you can make international transfers with fixed transaction fees. For more information, visit our remittance page.

Sources: 1.