Here's Everything You Need to Know: Establishing a Company in Turkey

In this article, you will find the basic steps and critical insights into the company formation process in Turkey. This guide can be a good starting point if you want to establish your own business or invest in Turkey.

How to Establish a Company in Turkey?

When you decide to establish a company, you will find it a multi-stage process. Decisions about your company's operational field, capital structure, and company type are vital for its future.

What Are the Stages of Company Formation?

Business Idea and Market Research

The first step in your company formation journey is to have a strong business idea. You should clearly define your business idea and identify your potential customer base. Additionally, analyzing your potential competitors to conduct a competitive analysis is critical for a better understanding of the market.

Creating a Business Plan

One of the fundamental elements of starting a successful business is having a detailed business plan. Your business plan should include how you manage your business, financial projections, marketing strategies, and other important information.

Choosing the Type of Company

When forming a company in Turkey, you must determine which type of company is best for you. Among the options such as Limited Liability Company, Joint Stock Company, and Sole Proprietorship, remember that every kind of company has specific advantages and obligations.

Understanding Legal and Tax Requirements

Starting a company in Turkey requires compliance with legal regulations and tax obligations. This involves a series of steps such as trade registry registration, chamber of trades and artisans registration, tax liability, permits, and licenses. Depending on the type of business, it may be beneficial to seek professional advice from a consultant or lawyer at this stage.

Capital and Financing Plan

Planning your company's startup capital and operating costs would be best. Financing sources are vital for starting and maintaining a business. Acknowledging that a well-managed cash flow ensures a longer lifespan for your company, we recommend finalizing your financing plan before establishing the company.

What Types of Companies Can Be Established in Turkey?

The general provisions and types of companies that can be established in Turkey are regulated in the Turkish Commercial Code No. 6102. According to the law, commercial companies are divided into two main groups: "capital" and "personal." These main groups include the following types of companies:

Capital companies:

Joint-Stock CompanyLimited Liability CompanyCommandite Company divided into shares

Personal companies:

Collective CompanySole Proprietorship (Ordinary Commandite Company)

Turkey's most commonly preferred types are joint stock and limited liability companies.

What Should You Consider When Establishing a Company?

While undertaking these processes, you should pay attention to some key points. Before establishing your company, you should carefully determine your plans and goals. Reviewing your capital structure and making a draft plan for the coming years can make choosing a company type easier. For example, if you are considering starting a large-scale cleaning company, you can choose a limited liability or joint-stock company. However, you might prefer to establish a sole proprietorship for a smaller-scale venture like a crafts shop, workshop, etc.

Each company type has its advantages and disadvantages. Therefore, being knowledgeable about the characteristics of all company types can be very beneficial.

What Are the Features of a Limited Liability Company?

A limited liability company can be established with a minimum capital of 50,000 TL. It can be established by a single person or can have up to 50 partners, whether natural or legal persons. The corporate bodies of a limited liability company are the General Assembly of Partners and the Board of Directors/Managers. The general assembly is the highest decision-making body representing all partners, while the board of directors/managers is responsible for the management and representation of the company. The transfer of shares in a limited liability company requires general assembly approval.

What Are the Advantages of Establishing a Limited Liability Company?

Partners in a limited liability company are not personally liable for company debts. Since there’s a legal entity, company partners must only pay the capital share corresponding to their ownership percentage. If there are public debts, each partner is responsible for them in proportion to their share in the company. According to the Turkish tax system, limited liability companies are subject to corporate tax instead of income tax. This means paying a fixed tax of 20% on the income base instead of increasing yearly taxes.

What Are the Disadvantages of Establishing a Limited Liability Company?

Compared to joint stock companies, limited liability companies cannot go public or issue bonds, and closing a limited liability company can take longer than a sole proprietorship. Also, the number of partners in limited liability companies is limited to 50. This limit can become a disadvantage when the company needs to grow and add new partners.

What Documents Are Required To Establish a Limited Liability Company?

The documents required to establish a limited liability company are as follows:

- Formation notification form

- Petition

- Contract certified by a notary

- Chamber registration declaration

- Rental contract for the company office

- Receipt showing the capital has been deposited

- Written declarations from non-partner directors accepting their role

- Signature circulars for the company managers

- Payment document showing the Competition Authority fee has been paid

- If there is a legal entity on the board of directors, a notarized copy of the decision by the competent body designating a natural person on behalf of the legal entity, along with the name and surname of the designated person

- If applicable, valuation reports prepared by a court-appointed expert for assets and businesses to be taken over at the time of establishment and for other assets contributed as capital.

- If capital contributions have been made in kind, a document from the relevant registry stating that there are no restrictions on the contributed capital

- If capital contributions have been made in kind, a document proving that the real estate, intellectual property rights, and other values contributed as capital have been registered in their respective registries

- If applicable, contracts made with the founders and other persons related to the establishment of the company, including those associated with the transfer of assets and the business

- If the company's establishment is subject to the approval or favorable opinion of the Ministry or other official institutions, this approval or good opinion letter

When these documents are declared in writing to the Trade Registry Directorate, establishing a limited liability company officially begins.

What Is the Cost of Establishing a Limited Liability Company?

As of 2024, establishing a limited liability company costs approximately 10,000 TL. When adding up the certified public accountant service fee, stamp tax, notary fees, chamber of commerce registration announcement expenses, and capital duty, a minimum cost of around 10,000 TL can be expected. Of course, this cost can vary depending on the partnership structure of the company, the fees set by the intermediaries, and other factors.

What Are the Features of a Joint-Stock Company?

A joint stock company has a specified capital divided into shares. With an update made on January 1, 2024, the minimum capital requirement for a joint stock company has been set at 250,000 TL. For non-public joint-stock companies that accept the registered capital system, this amount is 500,000 TL. At least one-fourth of this amount must be paid during the company's establishment. The shareholders can pay the remaining amount within 24 months after the company's establishment.

The management bodies of a joint stock company are divided into the General Assembly and the Board of Directors. The General Assembly is responsible for important decisions concerning all shareholders. The Board of Directors is responsible for the management and representation of the company. In this respect, it is similar to a limited liability company.

What Are the Advantages of Establishing a Joint-Stock Company?

There are many advantages to establishing a joint-stock company in Turkey. The liability of the partners is limited. Joint stock company partners are only responsible to the company for the capital shares they have committed. This protects the personal assets of the partners.Capital can be easily increased. Joint-stock companies can raise their capital with a decision of the board of directors. This facilitates the acquisition of the necessary capital for the company's growth. Joint-stock companies can go public to increase their capital. This enables the company to be recognized by more investors and to grow.

What Are the Disadvantages of Establishing a Joint-Stock Company?

Just as there are advantages to establishing a joint-stock company, there are disadvantages. There is a minimum capital requirement for establishing a joint-stock company. This capital has been set at 250,000 TL as of 2024. Additionally, joint-stock companies' structure is more complex than limited liability companies. This situation can lead to difficulties in the company's management and accounting processes. Capital increase fees, accounting, and consulting fees may be higher for joint-stock companies, creating an additional cost disadvantage. The process of closing a joint-stock company can take more time and effort than the other types.

What Documents Are Required To Establish a Joint-Stock Company?

The following documents must be prepared and submitted to the Trade Registry Directorate during the establishment of a joint-stock company:

- Formation notification form

- Petition

- Contract certified by a notary

- Chamber registration declaration

- Rental contract for the company office

- Receipt showing that at least 25% of the committed capital has been deposited into a bank

- If applicable, written declarations from non-shareholder members of the board of directors accepting their role

- Signature circulars for the individuals representing the company

- Payment document showing the Competition Authority fee has been paid

- If there is a legal entity on the board of directors, a notarized copy of the decision by the competent body designating a natural person on behalf of the legal entity, along with the name and surname of the designated person

- If applicable, valuation reports prepared by a court-appointed expert for assets and businesses to be taken over at the time of establishment and for other assets contributed as capital.

- If capital contributions have been made in kind, a document from the relevant registry stating that there are no restrictions on the contributed capital

- If capital contributions have been made in kind, a document proving that the real estate, intellectual property rights, and other values contributed as capital have been registered in their respective registries

- If applicable, contracts made with the founders and other persons related to the establishment of the company, including those associated with the transfer of assets and the business

- For companies whose establishment is subject to the approval or favorable opinion of the Ministry or other official institutions, this approval or good opinion letter

What Is the Cost of Establishing a Joint-Stock Company?

Establishing a joint-stock company may require legal and financial advisory services. As of 2024, establishing a joint-stock company costs approximately 11,000 TL. When different items such as the certified public accountant company establishment service fee, stamp tax, notary fees, chamber of commerce registration announcement expenses, and capital duty are combined, a minimum cost of around 11,000 TL can be expected. Of course, this cost can vary depending on the partnership structure of the company, the fees set by the intermediaries, and other factors.

What Are the Features of a Sole Proprietorship?

A sole proprietorship is a company owned by a single person, where the owner's liability for the company is unlimited. Although legally referred to as an “ordinary commandite company”, this type of company is commonly called a sole proprietorship in everyday use.The company owner has all the decision-making and authority in a sole proprietorship. Especially freelance professionals, artisans, and those wanting to conduct small-scale e-commerce activities often choose to establish a sole proprietorship. This allows them to carry out tax, accounting, and other official transactions by the law and become business owners.

Can There Be Partners in Sole Proprietorship Companies?

Sole proprietorships can also be established with more than one person. These types of companies are called Collective Companies. Like a sole proprietorship, there is no minimum capital requirement for collective companies, which only natural persons can establish. The partners are liable for the company's debts and credits with their personal assets.

What Are the Advantages of Establishing a Sole Proprietorship?

A sole proprietorship requires fewer bureaucratic procedures than other companies and can be quickly established. Additionally, the company owner is legally responsible for the company's commercial activities. This allows sole proprietorship owners to use their personal assets as collateral for the company's debts. Sole proprietorships are easy to manage. In sole proprietorships, the company management is conducted by a single person.

What Are the Disadvantages of Establishing a Sole Proprietorship?

In sole proprietorships, all responsibility lies with the company owner. While this can be an advantage, it can also create disadvantages. In case of any debt, the company owner is fully responsible for the debt and may have to use personal assets to pay it off. Sole proprietorships have a tax disadvantage compared to other types of companies. Limited and joint-stock companies pay a 20% corporate tax, and this rate is fixed regardless of the income base. However, sole proprietorships are evaluated under Income Tax, and as the income base increases, the determined tax rates also increase. Another factor to consider when establishing a sole proprietorship is the growth potential of the established company. Due to the company management structure and tax disadvantages, the growth potential in sole proprietorships is more limited.

What Documents Are Required To Establish a Sole Proprietorship?

The documents required to establish a sole proprietorship are less than those for joint stock and limited liability companies. A sole proprietorship can also be opened within a few hours after submitting the documents. The documents required for the opening of a sole proprietorship are as follows:

- Photocopy of the company owner's identity card

- Photocopy of the title deed or rental agreement showing the company address

- Company owner's signature declaration

What Is the Cost of Establishing a Sole Proprietorship?

The establishment costs for sole proprietorships are lower. No capital is required to establish a sole proprietorship. However, a fee must be paid for company registration and tax plates. Although there is no exact price, including taxes, fees, and accounting services, a cost of at least 7,000 TL can be expected. This amount can vary from city to city and may increase if additional consultancy services are obtained.

Which Type of Company Should Be Chosen for E-Commerce?

Any company, whether joint stock, limited liability, or sole proprietorship, can be chosen for e-commerce activities. Many e-commerce platforms allow sales to be made through a sole proprietorship. However, for those planning to create their platform or to transform the company they establish today into a larger-scale e-commerce company in the future, our recommendation is to establish a joint stock or limited liability company. This way, bigger dreams can be envisioned for the future, and as a corporate taxpayer, one can benefit from lower tax advantages compared to a sole proprietorship.

What Are the Key Points To Consider When Establishing a Company?

Establishing a company is the first step towards achieving dreams for many entrepreneurs and a process that requires careful management. The decisions made during this process can affect the company's growth potential and have decisive results on tax and cost items.

For trade registry registration, every company must have its address. However, in joint-stock and limited liability companies, these addresses must be registered as office, workplace, workshop, or home office in the title records. In a sole proprietorship, the residence addresses of the company owner, whether as a homeowner or tenant, can also be registered as the business address.

Working with the right partners is very important to complete the company establishment stages. Regardless of the type of company, every company should work with a certified public accountant or establish a finance department. Otherwise, undesirable situations may occur, such as receiving penalties during financial audits.

Which Types of Companies Can Benefit From Papel Privileges?

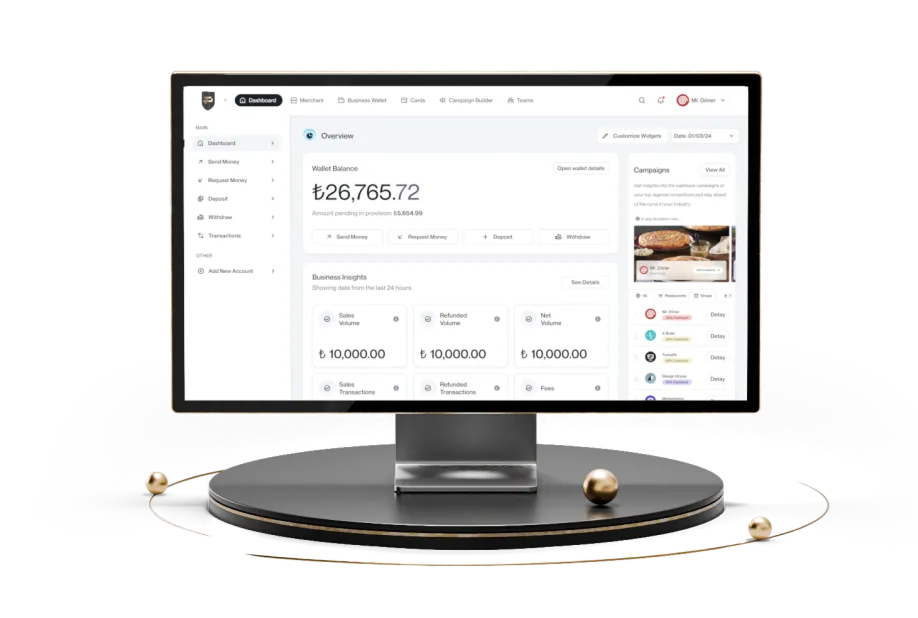

Companies of any type, whether joint-stock, limited liability, or sole proprietorship, can create a business account on Papel and benefit from Papel privileges. Services such as MobilePOS, Papel Checkout, and PhysicalPOS can speed up the payment-receiving experience. With Papel PayLink, merchants can offer your customers a faster payment experience. Through the Papel Merchant Panel, they can easily manage their company's product and stock tracking, team management, store management, and other processes from a single screen.

To discover the services offered by Papel exclusively for businesses and to create a Papel Business Account immediately, visit papel.com.tr.