Fintech Solutions for SMEs: Take Your Business Digital

Today, financial technologies (fintech) play a crucial role in helping SMEs overcome challenges by providing fast, reliable, and cost-effective solutions. From digital payment systems to financing platforms, accounting software, and supply chain financing, FinTech solutions help businesses streamline and sustain their financial processes. So, why do SMEs need fintech solutions, how do these solutions benefit businesses, and what support is available for SMEs in Turkey? All the details are on Papel Blog!

Why Do SMEs Need Fintech Solutions?

Small and medium-sized enterprises (SMEs) need fintech solutions for efficient financial management. Fintech solutions help SMEs digitize their financial processes, making them faster, more reliable, and more cost-effective. Here are the key benefits that fintech solutions provide for SMEs:

Ease of collection: Thanks to fintech solutions, SMEs can receive payments quickly and securely through various digital methods, such as contactless payments via mobile applications. This improves cash flow, providing significant convenience for SMEs.

Financial management and reporting: Digital finance management tools automate processes such as income-expense tracking, budgeting, and financial analysis, making management more accurate and efficient and simplifying business operations.

Access to financing: Online lending platforms make it easier and faster for SMEs to access the funding they need. Unlike traditional banking, fintech solutions reduce bureaucratic hurdles and speed up processes.

Cost and time savings: Fintech solutions reduce operational costs by automating manual processes, allowing employees to focus more on strategic tasks.

What Are the Differences Between Traditional Banking and Fintech?

Traditional banks, which have existed for decades, serve their customers and businesses through physical branches and a wide range of financial products, but they are subject to strict regulations. On the other hand, fintech companies provide innovative, technology-driven financial services via digital platforms, offering more practical and user-friendly solutions. Here are the main differences between traditional banking and fintech:

Speed and Accessibility

Fintech solutions allow financial transactions to be carried out quickly via mobile applications and digital platforms. In contrast, traditional banking often requires customers to visit a physical branch, leading to longer processing times.

Customer Experience

Fintech companies prioritize user experience and make financial transactions more accessible and efficient. In contrast, traditional banks have bureaucratic processes, which can limit customer flexibility.

Variety of Products and Services

Traditional banks offer various financial products, including deposit accounts, loans, and investments. On the other hand, Fintech companies focus on specific financial services and develop innovative solutions in those areas.

Technological Infrastructure and Innovation

Fintech companies leverage technology to innovate quickly, whereas traditional banks often rely on older systems, making their digital transformation slower.

Challenges SMEs Face in Financial Management

Small and medium-sized enterprises (SMEs) face various challenges in financial management, which can directly impact their sustainability and growth. The key financial management challenges include:

Lack of Capital

Most SMEs rely on limited equity capital, making managing operational costs and unexpected expenses difficult.

Difficulty in Obtaining Loans

Financial institutions often view SMEs as risky borrowers, making it harder for them to secure loans. High interest rates and collateral requirements further limit SMEs' access to funding.

Cash Flow Issues

Irregular income flow and delayed payments can disrupt an SME's cash flow, making it challenging to maintain liquidity and pay bills on time.

Lack of Financial Knowledge

Many SMEs lack knowledge about financial management techniques, making it difficult for them to effectively perform budget planning, cost control, and financial analysis.

High Tax Burden and Complex Regulations

High tax rates and complex legal regulations increase operational costs and reduce profitability, limiting business growth.

Competition and Technological Adaptation

Keeping up with technological advancements and competing with larger companies is challenging for SMEs. With limited resources, SMEs may struggle to invest in technology, making it harder to gain a competitive advantage.

Best Fintech Solutions for SMEs

Small and medium-sized enterprises (SMEs) can leverage various fintech solutions to improve their financial processes and gain a competitive edge. Here are some of the most beneficial fintech solutions for SMEs:

Digital Payment Systems

Digital payment systems allow SMEs to accept payments quickly and securely. Digital payment solutions are costless and user-friendly compared to traditional payment methods, making them particularly beneficial for e-commerce businesses. Some of the most popular digital payment solutions include:

Virtual POS: Enables businesses to accept payments via credit or debit cards.

Mobile Payment Systems: Allows payments via phone numbers or QR codes.

Digital Wallets: Lets customers store card details for one-click payments.

Online Financing Platforms

Unlike traditional banking, online lending platforms provide SMEs with faster access to financing. These platforms help businesses secure funding by offering flexible lending options. Popular online financing options include:

Online loans: Provides quick access to business loans.

Invoice financing: Allows businesses to convert outstanding invoices into immediate cash.

Microloans: Offers small-scale loans to help SMEs cover urgent expenses.

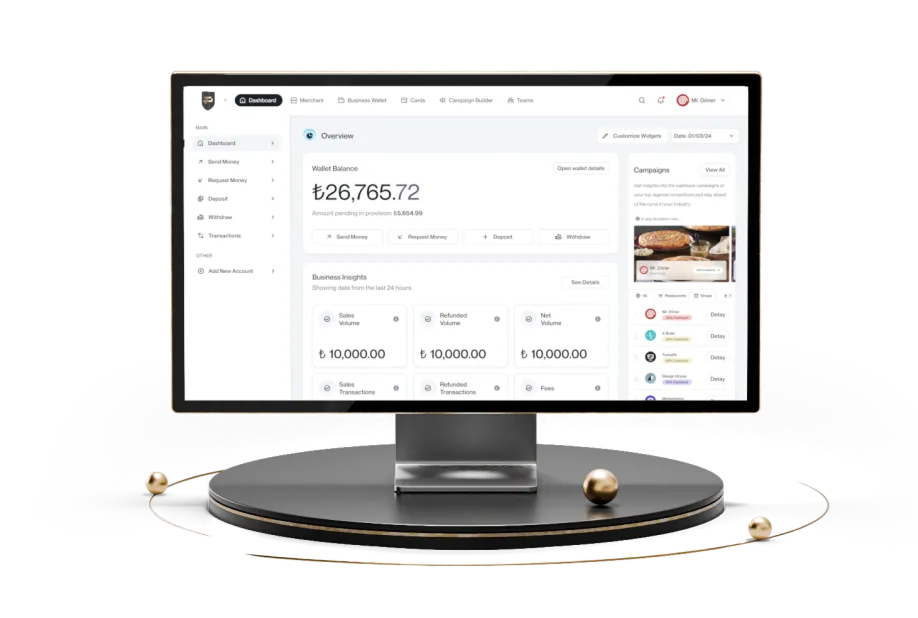

Financial Management and Accounting Software

Automated accounting and financial management software help SMEs manage their financial processes efficiently, saving time and resources. Some of the most commonly used tools include:

Cloud-based accounting software: Provides access to financial data from anywhere.

E-invoicing and digital archive solutions: Reduces paper consumption and speeds up processes.

Reporting and analysis tools: Offers real-time insights for strategic decision-making.

Digital Wallet Applications

Digital wallets enable cashless payments, allowing customers to make secure and fast transactions without carrying a physical wallet. Additionally, they offer loyalty programs and discount coupons, improving customer satisfaction.

Supply Chain Financing

Fintech solutions help SMEs pay suppliers faster, optimize supply chain processes, and improve operational efficiency.

Key Considerations for SMEs Using Fintech Solutions

While fintech solutions provide numerous benefits, SMEs should consider the following factors before adopting them:

Conducting a Needs Analysis

Before implementing fintech solutions, business needs and goals must be identified, and the right technologies must be chosen to avoid unnecessary costs.

Choosing Reliable and Compliant Platforms

Since financial data security is critical, SMEs should select fintech platforms that comply with legal regulations and have proven reliability.

Training Employees

New technologies require proper training to ensure employees use them effectively and minimize errors.

Cost and ROI Analysis

Assess fintech solutions' costs and expected returns to ensure a profitable investment.

Integration and Compatibility

Ensure that selected fintech solutions are compatible with existing systems to avoid operational disruptions.

Fintech Services and Incentives for SMEs in Turkey

Turkey offers fintech services and government incentives to support SMEs' digital transformation. Some key incentives include:

Digital transformation support from the Ministry of Industry and Technology. KOSGEB supports programs for SME growth and competitiveness. Investment incentive packages for business development, digitalization, and energy efficiency. New support programs for global competitiveness and capacity development.

To explore how Papel helps SMEs, check out Papel's SME solutions!