Everything to Know About Virtual POS: Commissions, Setup, and Required Documents

As discussed in this article, point-of-sale devices facilitate payment in exchange for goods or services.

Many of our online purchases are made through a virtual POS. These digital versions of physical POS devices have reached the capacity to handle high volumes of transactions daily, especially with the rapid growth of the e-commerce sector.

Virtual POS devices accept payments from banks and credit cards, prepaid cards, and digital and mobile wallets. This allows businesses to receive online payments quickly, easily, and securely.

How to Obtain a Virtual POS?

In Turkey, relevant laws and regulations allow businesses to obtain virtual POS services only from banks and licensed payment and electronic money institutions. The choice of a payment service provider should consider factors such as your business's sector, size, POS commission rates of payment institutions, integration capabilities, ease of virtual POS setup, and operating fees.

What are the Advantages of Using a Virtual POS?

Today, having a digital presence and a strong payment infrastructure is crucial, regardless of whether you are a company with outlets across the globe or an individual seller looking to make extra money online. Virtual point-of-sale (POS) offers countless benefits, some of which are as follows:

- Easy access to international customers

- The ability to sell 24/7

- Enhanced customer satisfaction

- Improved cash flow

- Increased operational efficiency

- A faster and more secure payment infrastructure

- Tailored payment experiences for consumers and markets

- Advanced reporting tools

Things to Consider When Choosing a Virtual POS

You should consider various criteria when selecting a virtual POS for your company. Low commission rates, fast integration, the ability to accept payments from all banks and credit cards, virtual POS setup fees, transaction fees, and compliance with regulations will help you find the best virtual POS for your needs.

What Documents are Needed for a Virtual POS?

Here, clarifying the 'required conditions' might be helpful. Almost all banks and companies licensed by the BDDK in Turkey offer virtual POS services. Although the required documents may vary depending on the company providing the virtual POS service, the generally documents needed for a virtual POS application are:

- Tax Plate

- Signature Circular

- ID Copy

- Proof of Address/Residence (for the Company Official)

- IBAN Information

- Temporary Tax Declaration for the Relevant Period

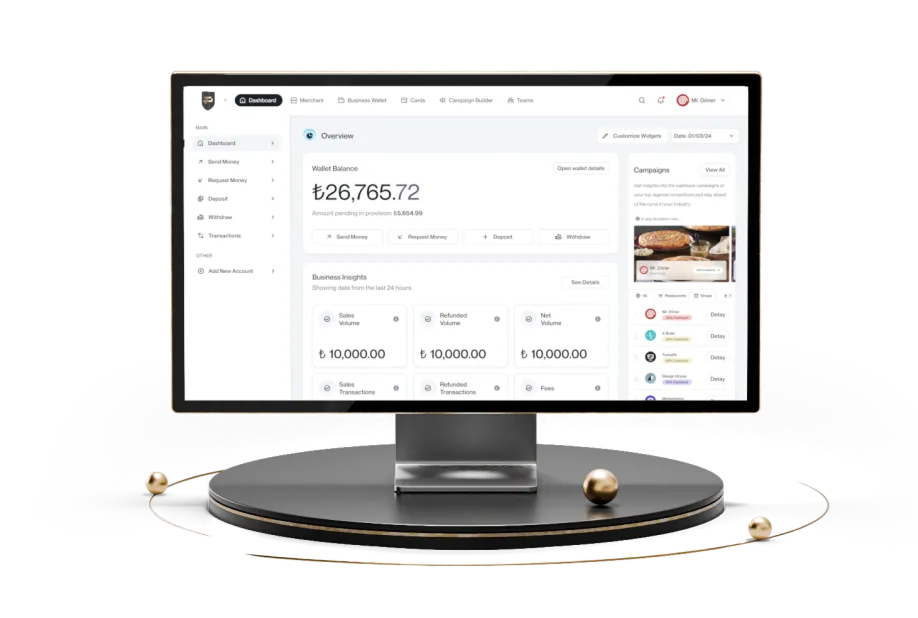

You can apply for Papel VirtualPOS with low commission rates, the advantage of quick setup, and no transaction fees. You can click here to join the Papel Business Panel and then quickly make your virtual POS application.

The documents required for the Papel VirtualPOS application are:

- Legal Entity's Title

- Trade Registry Number

- Tax Identification Number

- Field of Activity

- Official Address

- Identification Documents of the Person or Persons Authorized to Represent the Legal Entity

- Official Addresses of the Person or Persons Authorized to Represent the Legal Entity

Types of Virtual POS

Different needs have led to the development of various types of virtual POS. Generally, we can talk about three accepted types of virtual POS worldwide:

Hosted Payments Page (HPP)

A hosted payments page (HPP) temporarily redirects customers paying from your website to another page where transactions are carried out over an encrypted connection. It is the most basic version of a payment gateway connected to your e-commerce site.

Integrated Payment Gateway

An integrated payment gateway carries out transactions within your website, making the customer experience more personalized. However, its disadvantage is that its setup is more complex.

API-Hosted Gateways

API-hosted gateways provide a simple payment process on the business's website or app. Payment information is collected via an application programming interface (API). This option offers an accessible and integrated customer experience but requires the business to have a secure cardholder data environment to meet data protection standards.

Frequently Asked Questions

Is a Virtual POS safe?

In Turkey, relevant laws and regulations allow businesses to obtain virtual POS services only from banks and licensed payment and electronic money institutions, making online payments safer.

Which is the best virtual POS?

The best virtual POS is the one that meets your needs with the lowest commission rates, fastest integration, and highest efficiency. When researching, you should first clearly define your company's and your own needs and priorities. Then, you can apply to banks and payment institutions licensed by the BDDK and TCMB.

For more information about all of Papel's online payment solutions, click here.