Online Ödeme İptali Nasıl Yapılır?

Online alışverişin yaygınlaşmasıyla birlikte, ödeme sistemleri, iptal ve iade süreçleri de tüketiciler için önemli bir konu haline geldi. Birkaç tıkla yapılan alışverişin ardından yaşanan yanlış ürün gönderimi, hatalı işlem ya da fikir değişikliği gibi durumlarda online ödeme iptali ya da geri ödeme talebi gündeme gelebiliyor. Bu noktada tüketicilerin haklarını bilmesi ve süreçlerin nasıl işlediğini anlaması oldukça önemli. Bu yazımızda online ödeme işlemleri nasıl çalışır, hangi ödeme türleri iptal edilebilir; banka ve e-ticaret üzerinden iptal adımları nelerdir, geri ödeme ve chargeback (ters ibraz) süreci nedir sorularını yanıtlıyoruz.

Online ödeme işlemleri nasıl çalışır?

İnternet üzerinden ürün ya da hizmet satın alırken online ödeme yapılır. Müşterinin e-ticaret sitesinde oluşturduğu alışveriş sepetini onaylamasıyla başlayan online ödeme sürecinde ödeme sayfasında kredi kartı, banka kartı, dijital cüzdan veya havale gibi ödeme yöntemlerinden biri seçilir. Müşterinin girdiği ödeme bilgileri güvenlik amacıyla şifrelenir ve ödeme geçidine iletilir. Ödeme geçidinde bilgiler, ödeme işlemcisinin anlayacağı bir formata dönüştürülerek iletilir. Bir sonraki aşamada ödeme işlemcisi, alınan bilgileri Visa, Mastercard ve benzeri bir kart ağına ileterek işlemin doğrulanmasını sağlar. Kart ağının işlemi bankaya yönlendirmesinin ardından banka, müşterinin hesabında yeterli bakiye olup olmadığını ve işlemin güvenliğini kontrol eder. Bankanın kontrolleri tamamlandıktan sonra da onay ya da ret yanıtı ödeme işlemcisine geri iletilir. Ödeme işlemcisi, işlemin sonucunu ödeme geçidine iletir. Ödeme geçidi de bu bilgiyi hem müşteriye hem de satıcıya bildirir. Onaylanan işlemlerde, satıcı siparişi işleme alır. Bütün bu süreç tamamlandıktan sonra onaylanmış olan işlemler genellikle gün sonunda toplu olarak bankaya iletilir ve banka da işlemlerin toplam ücretini satıcının hesabına aktarır.

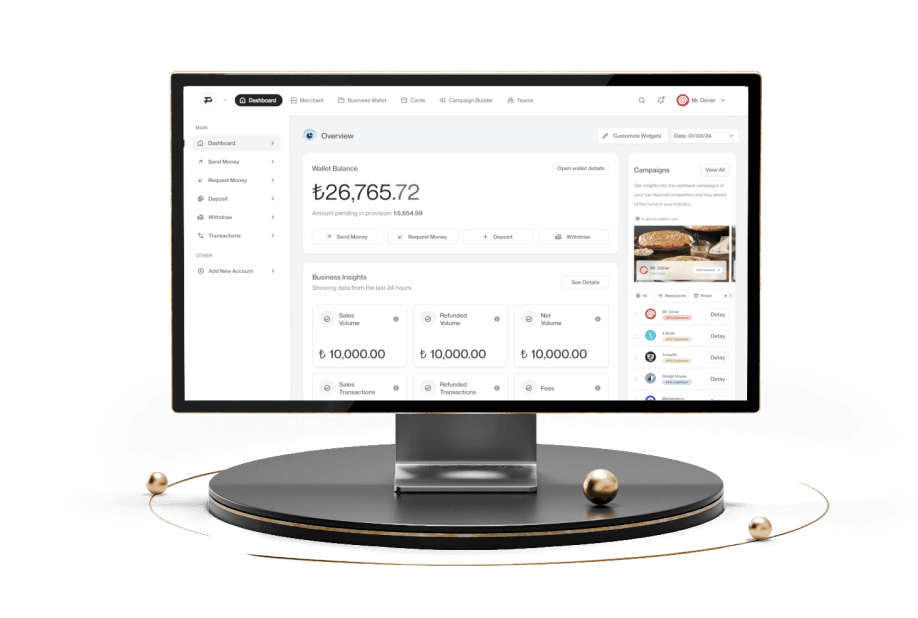

Papel ile Öde ödemelerini yaparken hayatını kolaylaştıracak online ödeme çözümlerinden biridir. Papel ile Öde sayesinde hızlı ve güvenli bir şekilde ödemelerini yapabilirsin. Daha fazla bilgi için Papel ile Öde sayfamızı ziyaret edebilirsin.

İptal edilebilir ödeme türleri nelerdir?

Online ödeme yaparken çeşitli ödeme yöntemleri tercih edilebilir. İşlem iptalleri ödeme yöntemine, işlemin durumuna ve ilgili tarafların politikalarına göre değişiklik gösterebilir. Bundan dolayı herhangi bir ödeme yapmadan önce ilgili hizmet sağlayıcının ya da satıcının iade ve iptal politikalarını incelemeni öneririz. İptal edilebilen başlıca ödeme yöntemleri ise şu şekildedir:

Kredi kartı ve sanal POS işlemleri

Online alışverişinin ödemesini kredi kartı ya da sanal POS aracılığıyla yaptıysan ve işlem henüz provizyondaysa genellikle işlemini iptal etmen mümkün. Bankanı arayarak provizyondaki işleminin iptal edilmesini isteyebilirsin. Fakat işlem onaylandıysa iptal etmek için satıcının iade sürecini başlatması gerekir. Yani onaylanan işlemin iptali için satıcıyla iletişime geçerek iade talebinde bulunmalısın. İade işlemi tamamlandıktan sonra ödemen genellikle 7-14 iş günü içerisinde kartına yansıyacaktır.

Banka havalesi ve EFT işlemleri

Banka havalesi ya da EFT yoluyla gönderilen para henüz alıcının hesabına geçmemişse bankanı arayarak işlemin iptalini isteyebilirsin. Fakat işlemin tamamlandıysa iptal etmek mümkün olmayabileceği için böyle bir durumda alıcıyla iletişime geçerek ödemenin iadesini talep etmen gerekir.

Otomatik ödeme talimatları

Otomatik ödeme talimatlarını bankanın internet şubesi, mobil uygulaması ya da müşteri hizmetleri aracılığıyla kolayca iptal edebilirsin. Ayrıca ödeme talimatı verdiğin hizmet sağlayıcının online platformu üzerinden de iptal işlemi gerçekleştirilebilir.

Dijital abonelikler ve uygulama satın alımları

Dijital platformlar üzerinden yaptığın abonelikler ya da satın aldığın uygulamalar genelde belirli bir süre içerisinde iptal edilebilir. Bu süre dolduktan sonra iade alabilmek için doğrudan satıcıyla iletişime geçmen gerekir.

E-Ticaret alışverişleri

E-ticaret sitelerinden yaptığın alışverişlerde ürünün henüz kargoya verilmemişse siparişini iptal edebilirsin. Ürün kargolanmadan iptal edemediysen ve ürünün kargolandıysa da teslim aldıktan sonra belirli bir süre içinde iade talebinde bulunabilirsin. İade politikaları satıcıya ve platforma göre değişebileceğinden alışveriş yapmadan önce alışveriş yaptığın sitenin iade koşullarını incelemen sonrasında sorun yaşamaman için faydalı olacaktır.

Online ödeme iptali için adımlar

Ödeme yaparken kullandığın yönteme ve işlemin durumuna göre ödeme iptal süreçleri değişiklik gösterebilir. Banka ve e-ticaret sitesi üzerinden gerçekleşen iptal süreçleri ise şu şekildedir:

Banka üzerinden iptal işlemleri

Kredi kartı ya da banka kartıyla gerçekleşen online ödemeler işlemin provizyon durumuna göre değişir. İşlemin provizyondaysa yani ödeme henüz kesinleşmemişse bankanın müşteri hizmetlerini arayarak işleminin iptalini talep edebilirsin. İşlemin provizyondan geçmiş yani ödemen kesinleşmişse, iptal etmek için satıcıyla iletişime geçmen ve iade sürecinin başlatılmasını istemen gerekir. İptal ya da iade işleminden sonra ödemenin kartına yansıması 7-14 iş günü sürebilir.

E-ticaret sitesi üzerinden iptal süreci

E-ticaret siteleri üzerinden alışveriş yaptıysan siparişinin durumu ve seçtiğin ödeme yöntemine göre iptal sürecin değişebilir. Siparişin henüz kargolanmamışsa e-ticaret sitesine ulaşarak siparişinin iptalini isteyebilirsin. Eğer siparişin kargolanmışsa teslim aldıktan sonra, satıcının belirlediği süre içerisinde iade sürecini başlatmalısın. İadenin kabul edilmesi için e-ticaret sitesinin belirlediği iade prosedürlerini uygulaman önemlidir.

Geri ödeme (iade) süreci nasıl işler?

Online ödemelerde geri ödeme (iade) süreci tüketicinin cayma hakkını kullanmasıyla başlar. Belirli adımlardan oluşan bu süreç hem tüketicinin hem de satıcının yasal yükümlülüklerine göre yürütülür. Tüketicinin, satın aldığı ürünü teslim aldığı tarih itibariyle 14 gün içerisinde herhangi bir sebep sunmadan ve ücret ödemeden cayma hakkı vardır. Bu hak, 6502 sayılı Tüketicinin Korunması Hakkında Kanun kapsamında düzenlenmiştir. Tüketici cayma hakkını kullanmak istiyorsa satıcıya iade talebini iletmesi gerekir. Tüketici talebini genellikle e-ticaret sitesi üzerinden gerçekleştirebilir. Satıcı, iade talebini aldıktan sonra tüketiciyi iade süreciyle ilgili bilgilendirir. İadenin kabul edilmesi için tüketicinin, ürünü orijinal ambalajında, eksiksiz ve kullanılmamış şekilde satıcıya geri göndermesi gerekir. Eğer satıcı kargo ücretiyle ilgili ön bilgilendirme yaptıysa tüketicinin iade kargo ücretini ödemesi gerekebilir.

Ürün satıcının eline geçtikten sonra satıcı, ürünün iade şartlarına uygun bir şekilde gönderilip gönderilmediğini kontrol eder. Eğer ürün iade şartlarına uygunsa iade kabul edilir; uygun değilse tüketiciye iadenin kabul edilmediği bildirilir. İade kabul edildiyse satıcı, ödenen bedeli en geç 14 gün içinde iade etmek zorundadır. Bu iade genellikle ödemenin yapıldığı yöntemle gerçekleştirilir ve kredi kartı ile yapılan ödemelerde iade tutarının kartına yansıması bankanın işlem süresine göre değişebilir. Tüketicinin yasal haklarını korumak için geri ödeme süreci belirli kurallara bağlanmıştır. Bu yüzden alışveriş yapmadan önce iade politikalarına dikkat etmek ve iade sürecinde de istenen koşulları yerine getirmek sorunsuz bir iade süreci yaşayabilmek için önemlidir.

Chargeback nedir, nasıl uygulanır?

Chargeback yani ters ibraz, kredi kartıyla yapılan bir işlemin kart sahibinin talebiyle iptal edilmesi anlamına gelir. Bu süreçte kart sahibi, bankasına başvurarak gerçekleşen bir işlemi onaylamadığını, ürün veya hizmeti almadığını ya da dolandırıldığını söyler. Ayrıca, başvuru sırasında kart sahibinin ürünü teslim almadığına veya hizmetten faydalanmadığına dair belge ya da yazışmalar sunması gerekir. Banka, bu itirazı kart ağı üzerinden işleme alır ve satıcıdan savunma ister. Satıcı, işlemle ilgili belgeleri ve teslimat kanıtlarını sunarak kendini savunabilir. Eğer banka satıcının savunmasını yetersiz bulursa işlem iptal edilir ve ödeme kart sahibine iade edilir.

Chargebark sürecinde dikkat edilmesi gereken en önemli konu itirazın yasal süreler içinde yapılmasıdır. Bankadan bankaya değişiklik gösterebilen yasal süre genellikle işlem tarihinden sonraki 120 günü kapsar. Dolandırıcılığa karşı etkili bir çözüm olsa da kötü niyetle kullanılan ters ibraz satıcılar için riskli olabilir. Bu sebeple ödeme işlemleri sırasında hem alıcının hem de satıcının işlem belgelerini ve iletişim kayıtlarını saklaması herhangi bir mağduriyeti önleyecektir.

Bu blog yazısında sunulan bilgiler; yalnızca genel nitelikte olup hukuk, finans veya yatırım danışmanlığı teşkil etmemektedir. İçerik, bilgilendirme amacıyla hazırlanmış olup, özel durumlarınız için profesyonel danışmanlık almanız tavsiye edilir. Yazıda yer alan ifadeler, herhangi bir bağlayıcılık veya sorumluluk doğurmamakta, yalnızca yazarın değerlendirmelerini yansıtmaktadır. Alacağınız kararlarda tüm sorumluluk tarafınıza ait olup, Papel Elektronik Para ve Ödeme Hizmetleri A.Ş. bu bağlamda herhangi bir yükümlülük kabul etmemektedir.